Business Insurance in and around Auburn

Calling all small business owners of Auburn!

Cover all the bases for your small business

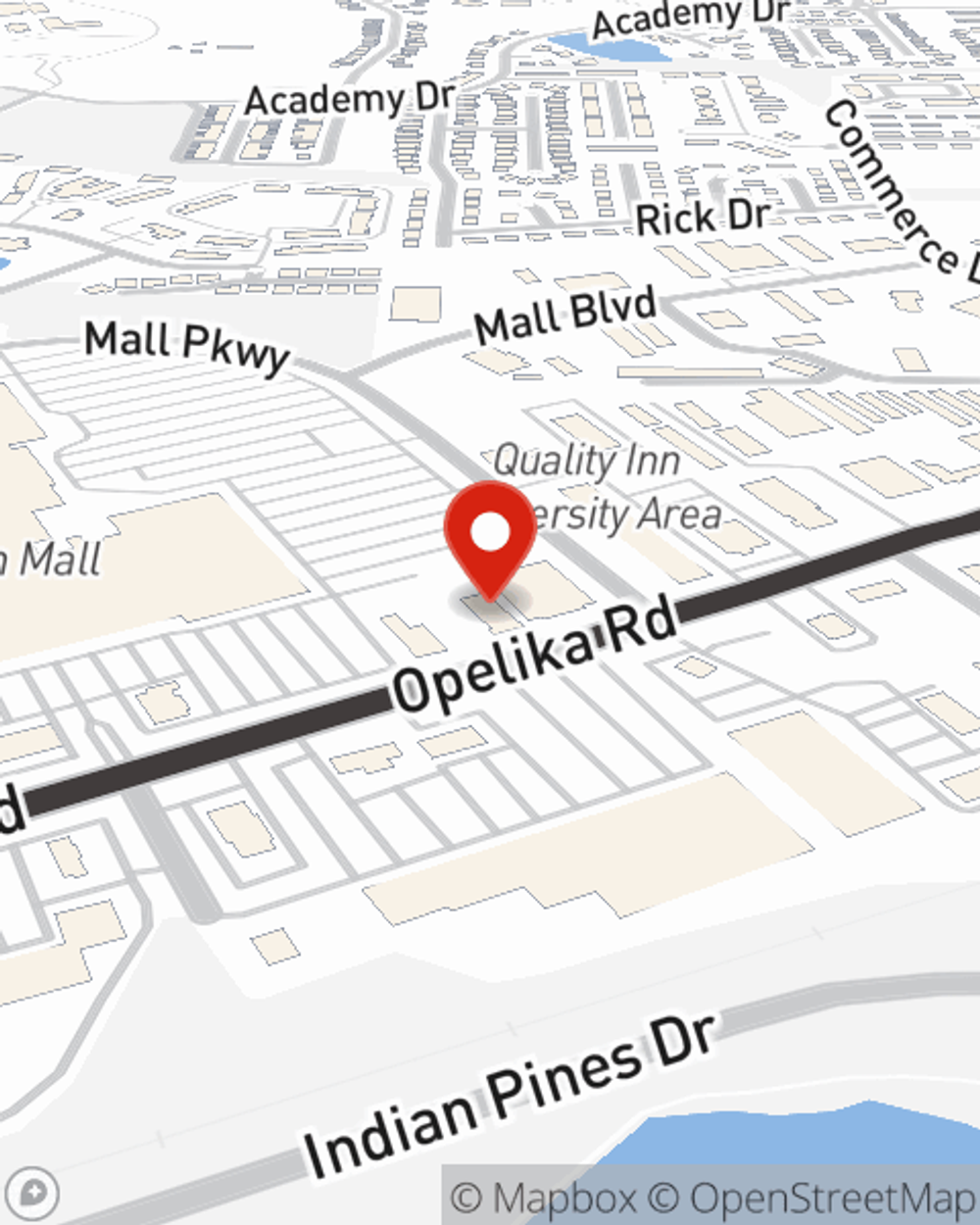

- Auburn, AL

- Opelika, AL

- Lee County, Alabama

- Alabama

- Georgia

- Auburn University

- Smiths Station

- Lee County

- Dadeville

- Waverly

- Alex City

- Auburn

- Opelika

Insure The Business You've Built.

Preparation is key for when something unavoidable happens on your business's property like a customer hurting themselves.

Calling all small business owners of Auburn!

Cover all the bases for your small business

Protect Your Future With State Farm

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like worker's compensation for your employees or a surety or fidelity bond, that can be created to develop a customized policy to fit your small business's needs. And when the unexpected does occur, agent Kathy Powell can also help you file your claim.

Don’t let worries about your business stress you out! Reach out to State Farm agent Kathy Powell today, and discover how you can save with State Farm small business insurance.

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Kathy Powell

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.